Nearly 75% of limited partners (LPs), or organizations and individuals investing into funds and non-direct investment entities such as family offices, high net worth individuals and corporate venture capital entities, are bullish on fintech in Southeast Asia with Indonesia perceived as the most attractive market, according to a new survey by tryb.

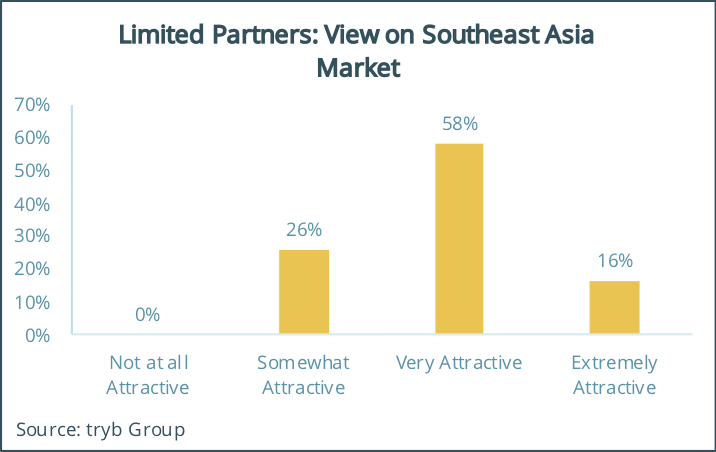

Limited Partners View on Southeast Asia Market, tryb Fintech and Limited Partner Survey 2018

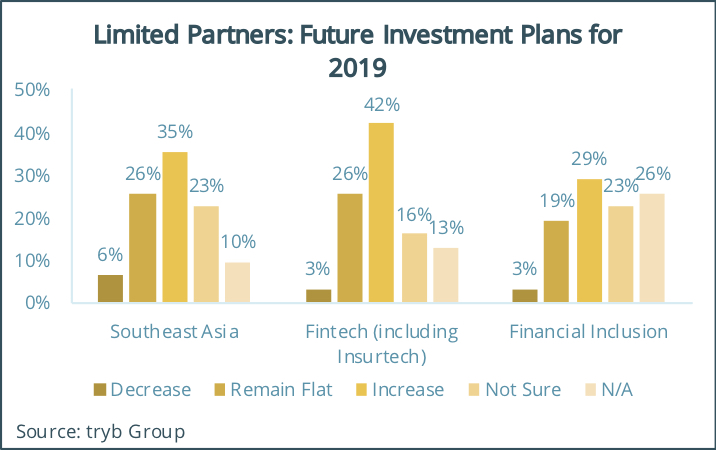

tryb, which surveyed over 85 respondents from a wide range of fintech sectors and LP segments across Asia, Europe and the US in late October 2018, found that nearly 60% of LPs reported that Southeast Asia is a “very attractive” market for fintech companies. Over 40% of LPs are planning to increase investment into fintech investment strategies in 2019.

Limited Partners Future Investment Plans for 2019, tryb Fintech and Limited Partner Survey 2018

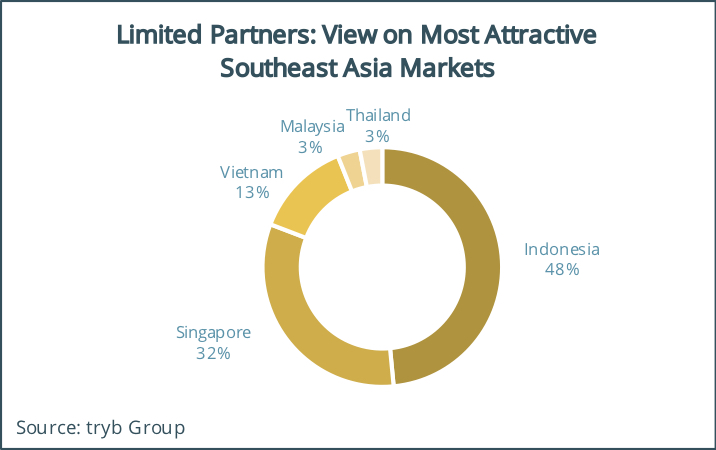

In particular, Indonesia is considered the most attractive market (48%), followed by Singapore (32%) and Vietnam (13%).

Limited Partners View on Most Attractive Southeast Asia Markets, tryb Fintech and Limited Partner Survey 2018

Indonesia, the largest economy in Southeast Asia with an estimated population of over 260 million people, has witnessed the rapid development of fintech with over 260 companies as of early 2018 and US$26 million raised in 2017, according to EY.

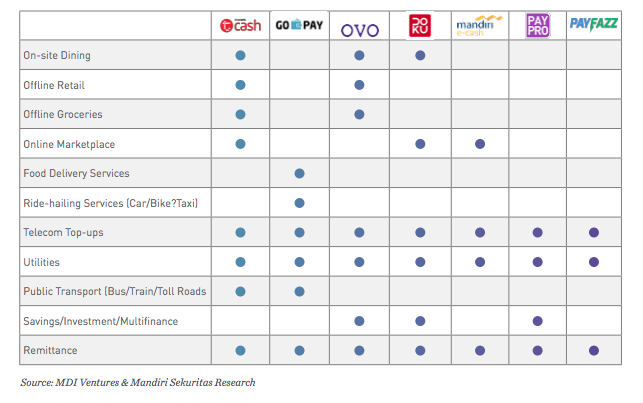

About 78 fintech companies are operating in the payments segment, while between 20 and 30 companies are in the lending, savings and investments segments each, showcasing the latter segments’ infancy and opportunity for growth.

According to the executive chairman of the Indonesian Financial Technology Association (Aftech), Kuseryansyah, five fintech sectors will experience significant growth in the country in the next five years, namely online payments, peer-to-peer (P2P) lending, insurtech, crowdfunding and price aggregators.

Kuserasyah noted that P2P lending could offer easily accessible small loans in a country where only 36% of the population is banked. Meanwhile, insurtech could serve the large pool of uninsured people in Indonesia, where only 1.7% of adults currently have an insurance program today.

“The insurance protection gap in Southeast Asia offers new possibilities for innovation in micro-insurance and community-based insurance, where new business models are about to emerge in e-commerce, auto, travel and health protection,” commented Evgenia Vorontsova, senior strategy project manager at Allianz.

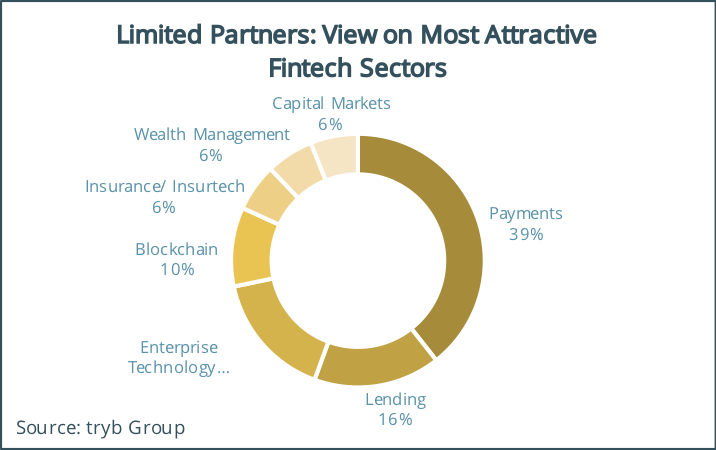

Similarly, the tryb survey found that payments (39%), lending (16%) and enterprise technologies (16%) in particular are perceived as the most attractive fintech sectors to LPs. Over 90% of LPs surveyed agree that fintech will support financial inclusion in Southeast Asia.

Limited Partners View on Most Attractive Fintech Sectors, tryb Fintech and Limited Partner Survey 2018

Fintechs’ perspectives

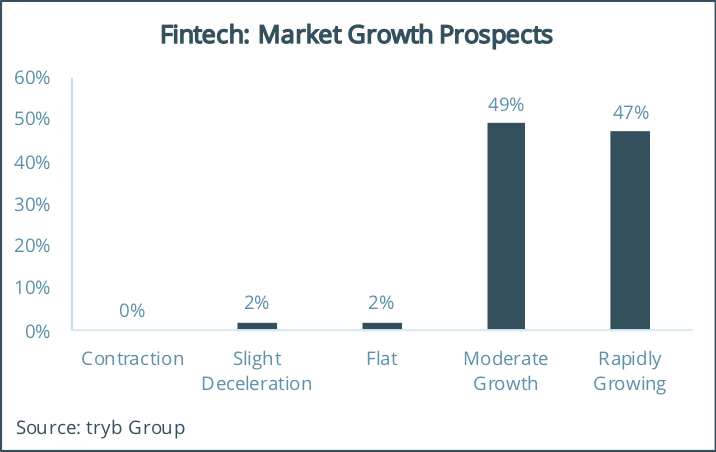

According to the tryb survey, fintechs too are optimistic about Southeast Asia’s growth prospects and the fundraising environment. Most fintechs expect “moderate to rapid growth” in their markets, and are now focused on scaling and fundraising.

Market Growth Prospects, tryb Fintech and Limited Partner Survey 2018

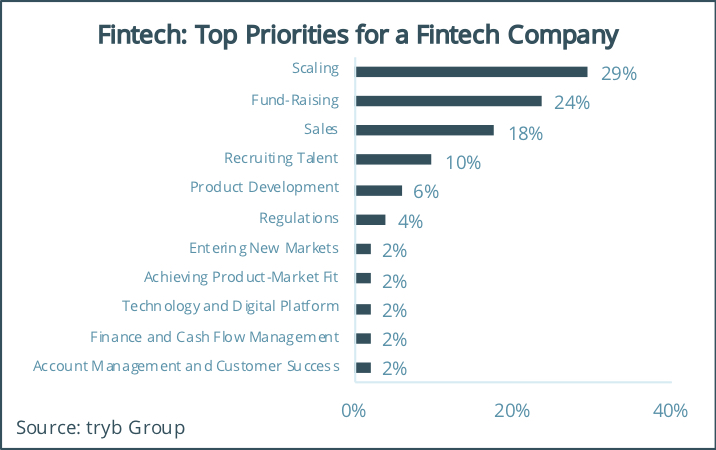

“Southeast Asian companies have raised some capital and are now putting efforts into scaling across the region. It is time to bring products to market and produce numbers for the next fundraising round,” said Markus Gnirck, co-founder of tryb Group. “One of the most under-appreciated challenges for entrepreneurs is balancing the effort needed to raise capital and managing a business to scale.”

Three quarters of the fintech companies surveyed are currently raising capital. Fundraising was named the most impactful way that investors can help a fintech achieve their goals. Fintechs also feel that investors can add value by leveraging networks (15%) and assisting with scaling (14%).

About a third of fintechs receive guidance, advice or operational support from their investors every month, followed by ad-hoc (22%) and weekly (18%) support.

Top Priorities for a Fintech Company, tryb Fintech and Limited Partner Survey 2018

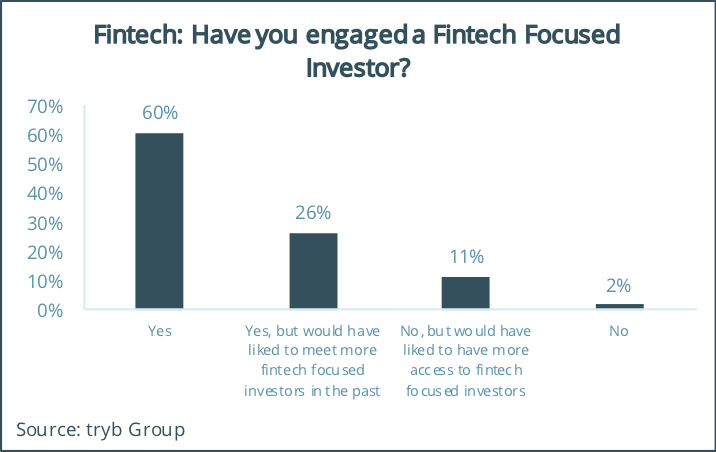

The survey findings also highlight the strong demand from fintechs and LPs for investors with specific mandates and expertise in fintech.

Over 85% of respondents have met with or pitched to a fintech-focused investor while nearly 40% reported they would have liked more access to fintech focused investors in the past.

Almost all fintech respondents would want to access more fintech-focused investors in the future, the research found.

Have you engaged a Fintech-Focused Investor, tryb Fintech and Limited Partner Survey 2018

The tryb study echoes predictions from other top firms. According to a recent study by US-based consultancy Bain & Company, the investment ecosystem in Southeast Asia is poised for growth, driven by strong investor interest in the region’s tech sector, especially the fintech space.

Over 60% of investors from Southeast Asia cited technology as their focus area in 2018 and 2019 with fintech being the largest sub-sector, ahead of artificial intelligence and blockchain.

Featured image via unsplash.

The post Investors Bullish on Fintech in Southeast Asia, Especially Indonesia appeared first on Fintech Singapore.

Masayoshi Son, Chairman & CEO of SoftBank Group said, “Indonesia’s technology sector has huge potential. I’m very happy to be investing US$2 billion into the future of Indonesia through Grab.”

Masayoshi Son, Chairman & CEO of SoftBank Group said, “Indonesia’s technology sector has huge potential. I’m very happy to be investing US$2 billion into the future of Indonesia through Grab.” Anthony Tan, CEO of Grab, said, “With our presence in 224 cities, Indonesia is our largest market and we are committed to long-term sustainable development of the country. We are delighted to facilitate this SoftBank investment, as we believe by investing in digitizing critical services and infrastructure, we hope to accelerate Indonesia’s ambition to become the largest digital economy in the region and improve the livelihoods of millions in the country.”

Anthony Tan, CEO of Grab, said, “With our presence in 224 cities, Indonesia is our largest market and we are committed to long-term sustainable development of the country. We are delighted to facilitate this SoftBank investment, as we believe by investing in digitizing critical services and infrastructure, we hope to accelerate Indonesia’s ambition to become the largest digital economy in the region and improve the livelihoods of millions in the country.”